florida estate tax filing requirements

No Florida estate tax is due for decedents who died on or after January 1 2005. The exemption is subtracted from the assessed value of your home.

Floridas estate tax is based on the allowable federal credit for state death taxes.

. Ad Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. The Estate Tax is a tax on your right to transfer property at your death. For example if probate assets are 100000 legal fees.

Download Or Email Form DR-312 More Fillable Forms Register and Subscribe Now. Florida does not have an estate tax or income tax so the only taxes that can apply to a Florida estate are federal taxes. For dates of death beginning January 1 2005 if the estate is not required to file Internal Revenue Service.

The estate will not have any tax filing or payment obligations to the state of Florida. Additionally counties are able to levy local taxes on top of the state. Executors duties in Florida include taking control of the decedents.

PDF 220KB Fillable PDF 220KB DR-1FA. An estate administrator must file the final tax return for a deceased person separate from their estate income tax return. The types of taxes a deceased taxpayers estate.

If youre putting together your Florida estate plan its wise to consider whether youll need to pay a federal estate tax. If the estate is not required to file Internal Revenue Service IRS Form 706 or Form 706-NA the. However if the decedent owed Florida intangibles taxes for any year before the repeal of the intangibles.

Sales tax is added to the price of taxable goods or services and collected from the purchaser at the time of sale. Legal fees for a Formal Estate Administration must be reasonable but are typically three percent of the probate assets. Florida homestead properties receive up to a 50000 exemption from property taxes.

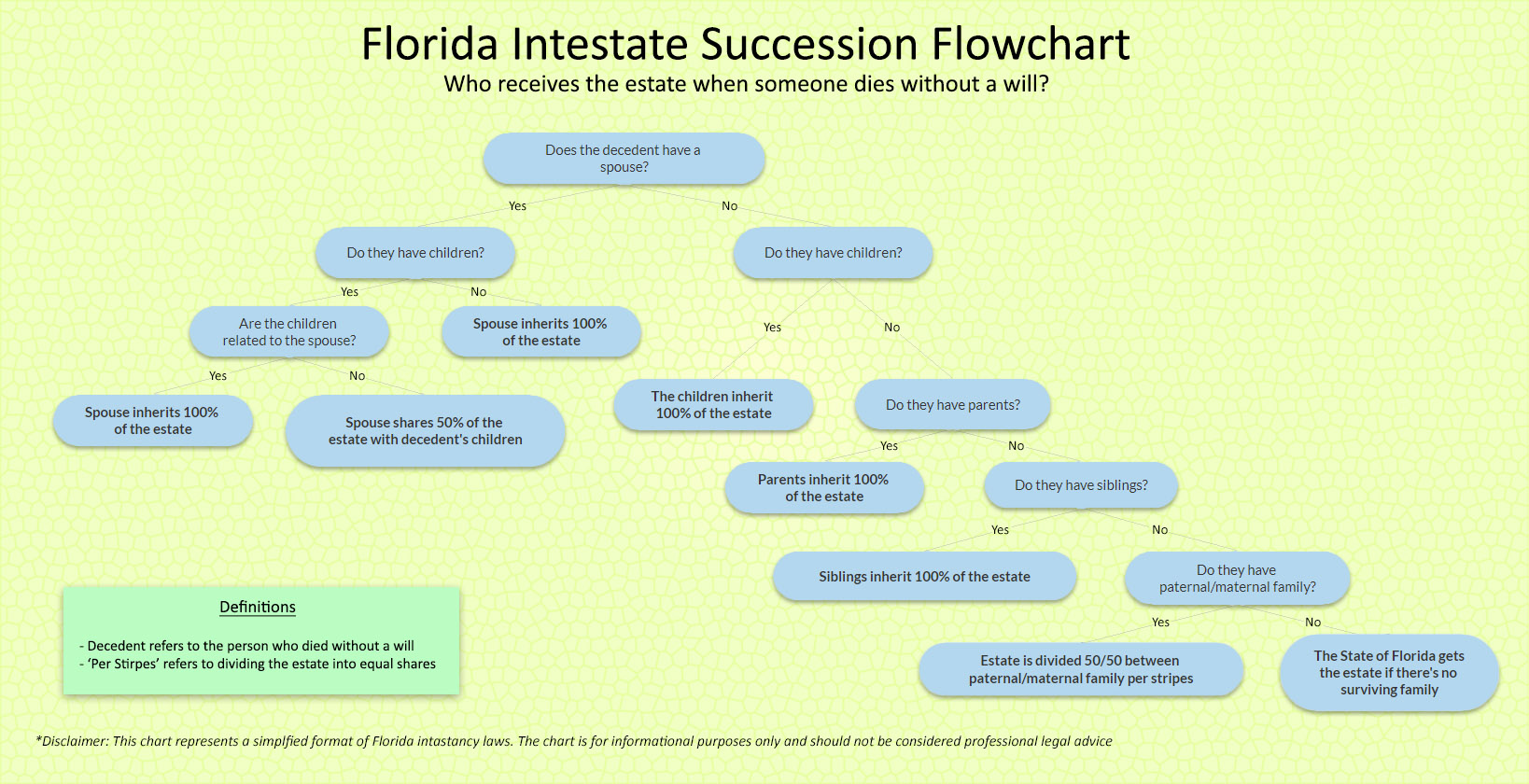

Florida tax is imposed only on those. Executors administer an estate under a valid will. Florida does not have an inheritance tax so Floridas inheritance tax rate is.

If the death occurs on or after January 1 2000 but before January 1 2005 the personal representative must comply with the two requirements listed above and. ACH-Credit Payment Method Requirements Florida eServices. The state charges a 6 tax rate on the sale or rental of goods with some exceptions such as groceries and medicine.

Executors must be over 18 and capable of performing the duties. As a result of recent tax law changes only those who die in 2019 with. The estates executor is also responsible for filing the decedents final income tax return and taking care of any other tax obligations.

Floridas general state sales tax rate is 6 with the following exceptions. It consists of an accounting of everything you own or have certain interests in at the date of death Refer to. Ad Real Estate Family Law Estate Planning Business Forms and Power of Attorney Forms.

Application for Consolidated Sales and Use Tax Filing Number. An inheritance tax also called an estate tax is a tax based on the wealth of a deceased person. No Florida estate tax is due for decedents who died on or after January 1 2005.

One of the most important steps is to make. In 2022 the estate tax threshold for federal estate tax. Florida estate tax due.

For example if your. Get Access to the Largest Online Library of Legal Forms for Any State. Estates subject to federal estate tax filing requirements and entitled.

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

Irrevocable Trusts What Beneficiaries Need To Know To Optimize Their Resources J P Morgan Private Bank

Florida Property Tax H R Block

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Estate Tax And Inheritance Tax Considerations In Michigan Estate Planning

Does Florida Have An Inheritance Tax Alper Law

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Does Florida Have An Inheritance Tax Alper Law

The Florida Homestead Exemption Explained Kin Insurance

Six Ways You Can Legally Avoid At Least Part Of Your Florida Property Tax Bill

Estate Tax Law Changes What To Do Now

Does Florida Have An Inheritance Tax Alper Law

Florida Probate Rules Processes What You Need To Know

/estate_taxes_who_pays_what_and_how_much-5bfc342146e0fb00265d85b5.jpg)